- CALL US FREE ON

Estate Agent Fees Calculator

Find out how much you’ll pay an estate agent to sell your home.

Reduce estate agent fees to zero

Avoid estate agent fees by selling your home to Property Rescue directly.

We pay cash for any home, in any condition, fast.

Tips and help

To help you better manage your expectations and budget effectively, our Estate Agent Fees Calculator allows you to quickly figure out how much you can be expected to pay in fees, based on your property’s expected sale price. Whether you’re just beginning the selling process or you’re close to making a final decision, understanding these fees clearly will ensure there are no unexpected surprises along the way.

How Does This Calculator Work?

Our Estate Agent Fees Calculator makes it simple to estimate how much you’ll pay in fees when selling your property. It factors in both the estate agent’s percentage fee and the VAT, which is currently charged at the standard UK rate of 20%. Here’s how to use it step-by-step:

Step 1 – Enter Your Property Value:

Input the expected selling price of your property.

Step 2 – Enter the Estate Agent’s Fee Percentage:

Enter the fee percentage agreed with your estate agent. Typically, this ranges between 1% and 3%, although it can vary.

Step 3 – Calculate Your Fees (including VAT):

Click “Calculate” to see the estimated estate agent fees inclusive of VAT.

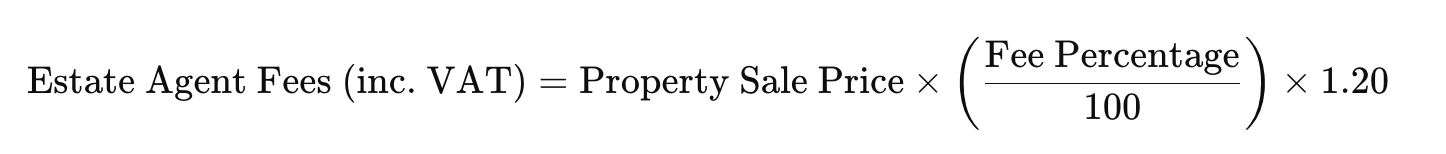

Calculation Formula with VAT:

The calculator uses this formula:

Example Calculation:

If your property is valued at £350,000 and your estate agent charges a fee of 1.5% + VAT, the calculation would be:

1. Calculate the fee before VAT:

£350,000 × (1.5 ÷ 100) = £5,250

2. Add VAT at 20%:

£5,250 × 1.20 = £6,300

In this example, your total estimated estate agent fee (including VAT) would be £6,300.

Understanding Estate Agent Fees?

Estate agent fees are charges that agents apply for marketing, negotiating, and successfully selling your property. These fees are typically calculated as a percentage of the final sale price of your home and are one of the largest costs involved when selling property in the UK. Normally VAT is charged on top of the quoted percentage so our calculator factors this in for you.

How Much are Estate Agent Fees Typically?

In the UK, estate agent fees usually range from 1% to 3% of the property’s sale price, plus VAT at 20%. However, fees can vary widely depending on:

- Location: Estate agent fees are often higher in more competitive housing markets, such as central London, due to increased demand and operating costs.

- Type of Contract: Sole agency agreements generally have lower fees, while multi-agency contracts—where multiple agents compete to sell the property—often attract higher fees.

- Property Value: Agents sometimes charge lower percentage fees on higher-value properties because the total amount earned is still significant.

- Services: Estate agents will often have basic and premium packages, with the more expensive packages offering more perks, such as increased levels of advertising. The package you choose affects the commission you’ll pay.

Services Covered by Estate Agent Fees?

Your estate agent’s fee typically covers several essential services, including:

- Valuation and pricing advice

- Professional photography and marketing of your property

- Listings on property portals such as Rightmove, Zoopla, and OnTheMarket

- Arranging and managing viewings

- Negotiating offers between you and potential buyers

- Sales progression, liaising with solicitors, and coordinating the sale through to completion

Understanding exactly what services are included can help you evaluate if the fees represent good value for money and avoid unexpected extra charges later in the process. Always clarify with your estate agent what’s covered under their quoted fee.

Who Pays the Estate Agent Fee?

In the UK, estate agent fees are almost always paid by the seller of the property. This means the cost of hiring an estate agent to market and sell your home is typically deducted directly from the proceeds of your sale upon completion.

When Do You Pay the Fees?

Estate agent fees become payable at the point of completion—the moment when contracts have been exchanged, funds transferred, and ownership officially changes hands. Usually, your solicitor or conveyancer will handle this transaction and ensure the agent’s fees are settled before sending you the remaining balance of your property sale. In most cases, if the sale falls through, the seller pays nothing, but this is worth clarifying with your estate agent.

Are There Any Exceptions?

While it’s very uncommon, there are rare scenarios where buyers might indirectly pay fees—for instance, when a property is sold through auction or in specific commercial transactions. However, in standard residential property sales across England, Scotland, Wales, and Northern Ireland, it remains standard practice that the seller covers the estate agent’s fees.

Why Does the Seller Pay?

The seller pays estate agent fees because the agent’s services primarily benefit the seller by helping to achieve the best possible sale price and managing the selling process. The estate agent acts on behalf of the seller, providing advice, market exposure, and negotiations to secure a successful property transaction.

Always ensure that fee responsibility and payment details are clearly set out in your contract with the estate agent to avoid misunderstandings.

Negotiating Estate Agent Fees?

Many sellers aren’t aware that estate agent fees aren’t set in stone—you can and should negotiate the best possible rate before you sign an agreement. Negotiating these fees could save you thousands of pounds, so it’s well worth understanding the best approach.

Tips for Negotiating Fees Effectively:

• Research Local Rates

Find out the typical percentage charged by multiple estate agents in your area so you’re equipped with realistic figures for negotiation with the agent you choose to work with. Knowledge about local market standards gives you an advantage.

• Get Multiple Quotes

Approach several estate agents to get a range of fee proposals. Use competitive quotes to negotiate better terms with your preferred agent.

• Consider Sole vs Multi-Agency Agreements

Sole agency contracts often offer lower fees, as the agent has exclusivity and higher certainty of receiving their commission. Multi-agency contracts typically have higher fees due to increased competition and risk for agents.

• Discuss Specific Services

If you don’t need certain services (such as premium listings or open houses), you may be able to negotiate a lower fee. Conversely, ensure all services you do want are included in your negotiated rate to avoid hidden costs later.

• Negotiate Early

Discuss fees upfront, ideally during your initial consultation. Once you’ve signed a contract, renegotiation is typically much harder.

Remember, estate agents are accustomed to fee negotiations—don’t feel uncomfortable discussing this openly. The agent wants your business, so assertive but polite negotiation can often result in significant savings.

FAQs about Estate Agent Fees

Here are answers to some frequently asked questions about estate agent fees, providing clarity and helping you make informed decisions when selling your property.

Yes, estate agent fees are negotiable. Agents typically offer some flexibility, so don’t hesitate to discuss and agree on a rate that suits both parties.

Generally, quoted estate agent fees exclude VAT, meaning you’ll need to add the standard UK VAT rate (currently 20%) to get the total payable amount. Always clarify whether VAT is included when discussing fees with your agent.

Usually, estate agents work on a no sale, no fee basis. This means if your property does not sell, you generally won’t have to pay any fees. However, always double-check your contract terms for exceptions.

Online estate agents typically charge lower fees—often a fixed, upfront price—but may offer fewer services compared to traditional high-street agents. Carefully compare what each option includes and decide based on your needs.

Yes, by selling your home privately, without an agent. This option, however, means you need to find a buyer yourself. The easiest way to find a buyer is to contact Property Rescue. We are a house buying company and we will buy any home in England or Wales, regardless of location, condition, or situation. We can appoint solicitors and surveyors to handle every aspect of the sale so you don’t need to pay a penny. The house can be sold in just a week or two of you contacting us.

Most traditional estate agents charge their fees only upon successful completion of the property sale. Some online agents may request upfront payment or partial payment in advance.

Not necessarily. A higher fee doesn’t always equate to better service. Always research an agent’s reputation, customer reviews, track record, and included services rather than making decisions based solely on the fee percentage.

Having clarity on these common questions will help you approach the estate agent selection process confidently and ensure you achieve the best outcome for your property sale.

Can’t find the answer you’re looking for? Feel free to contact us