Selling a house with a mortgage can feel like walking a tightrope. Stop paying too early, and you risk defaulting. Pay too long, and you’re chucking money down the drain.

So here’s the straight answer…

You stop paying your mortgage when the sale completes – not before.

In this guide, I’ll break down the nuts and bolts of how mortgage payments work during a sale, what happens between exchange and completion, how your final mortgage figure is calculated, and how to deal with things like direct debits, overpayments and early repayment charges (ERCs).

Let’s dive in.

Exchange vs Completion: What’s the Difference (And Why It Matters)?

Here in the UK, two key events define a house sale:

1. Exchange of Contracts

- This is when the deal becomes legally binding.

- The buyer pays a deposit (usually 5–10%).

- The completion date is fixed in stone at this stage.

But here’s the thing: you’re still the legal owner until completion. So the mortgage is still your responsibility.

Even if you’ve exchanged contracts, interest continues to build on your loan until it’s actually paid off. So don’t cancel your mortgage payments yet.

2. Completion Day

This is the finish line.

- The buyer’s solicitor transfers the full payment.

- Your solicitor pays off your remaining mortgage balance.

- The buyer officially becomes the new owner.

From this moment on, your mortgage is settled, and you no longer need to make payments. That’s your green light to cancel your direct debit.

Rule of thumb? Keep making payments right up until the completion date. If your usual payment falls before completion, pay it. You’ll get a refund or adjustment later.

How Lenders Work Out Your Final Mortgage Payment

Before completion, your solicitor will request something called a mortgage redemption statement.

This is your lender’s official “invoice” showing how much you owe, down to the penny.

It includes:

- Outstanding loan balance

- Accrued interest (calculated daily)

- Redemption/closure fees (admin charges)

- Any Early Repayment Charges (ERCs)

Let’s say your mortgage payment is £600 due on the 1st, and you complete on the 15th.

Only 15 days of interest apply (£300 in this example). You might’ve already paid £600, so the lender will refund the extra £300 or subtract it from your redemption total.

Top tip: Redemption statements are usually valid for a couple of weeks. If your completion date shifts, your solicitor may need a revised one, because the interest keeps ticking up.

How To Manage Direct Debits & Overpayments

Direct Debits: When (Not) to Cancel Them

This is where a lot of sellers trip up.

DO NOT cancel your mortgage direct debit early.

Even if you’ve exchanged contracts, your lender and solicitor will both tell you to keep payments going until the mortgage is redeemed.

If completion is scheduled just before your regular payment date, you can ask your lender whether to cancel the upcoming direct debit. Some will say yes — just get it confirmed in writing.

Otherwise, let the payment go through. If you’ve overpaid, they’ll sort it out.

Best practice? Cancel your direct debit after your solicitor confirms that the loan has been paid off.

What About Overpayments, Interest-Only Loans, or Payment Holidays?

Overpaying Just Before Selling?

If you’ve been making overpayments — or thinking about it — here’s the deal:

- Regular overpayments lower your loan balance, which means less interest and possibly a smaller ERC if one applies.

- But dropping a big lump sum just before redemption? Might cause confusion if it hasn’t cleared before your solicitor gets the final redemption statement.

Pro tip: Make any overpayments well in advance or hold off and let the solicitor apply it at completion.

On an Interest-Only Mortgage?

Keep paying the interest as normal. The full principal will be paid off from the sale proceeds. Nothing changes here — your lender expects the loan settled in full on completion day.

Been on a Payment Holiday or Deferment Plan?

Make sure any paused or reduced payments are covered in your redemption figure. Your solicitor will account for it, but don’t assume it’s all been wiped clean.

Early Repayment Charges (ERCs): What They Are and How to Dodge Them

Here’s where sellers can get caught out.

If you’re in a fixed or discounted mortgage deal and you sell early, your lender might hit you with an ERC — typically 1–5% of the outstanding balance.

That could be thousands of pounds.

Want to avoid or reduce your ERC?

You’ve got a few options:

- Port your mortgage to your new property (if you’re buying another). This lets you keep your existing deal and often avoids the ERC.

- Time your sale to complete after your ERC period ends.

- Ask your lender for leniency — some waive the ERC if you’re selling due to hardship or completing just before your fix ends.

- Plan for it — if you must pay an ERC, factor it into your sale price and future budget.

Pro tip: Check your mortgage offer or recent statement to see if you’re inside an ERC period.

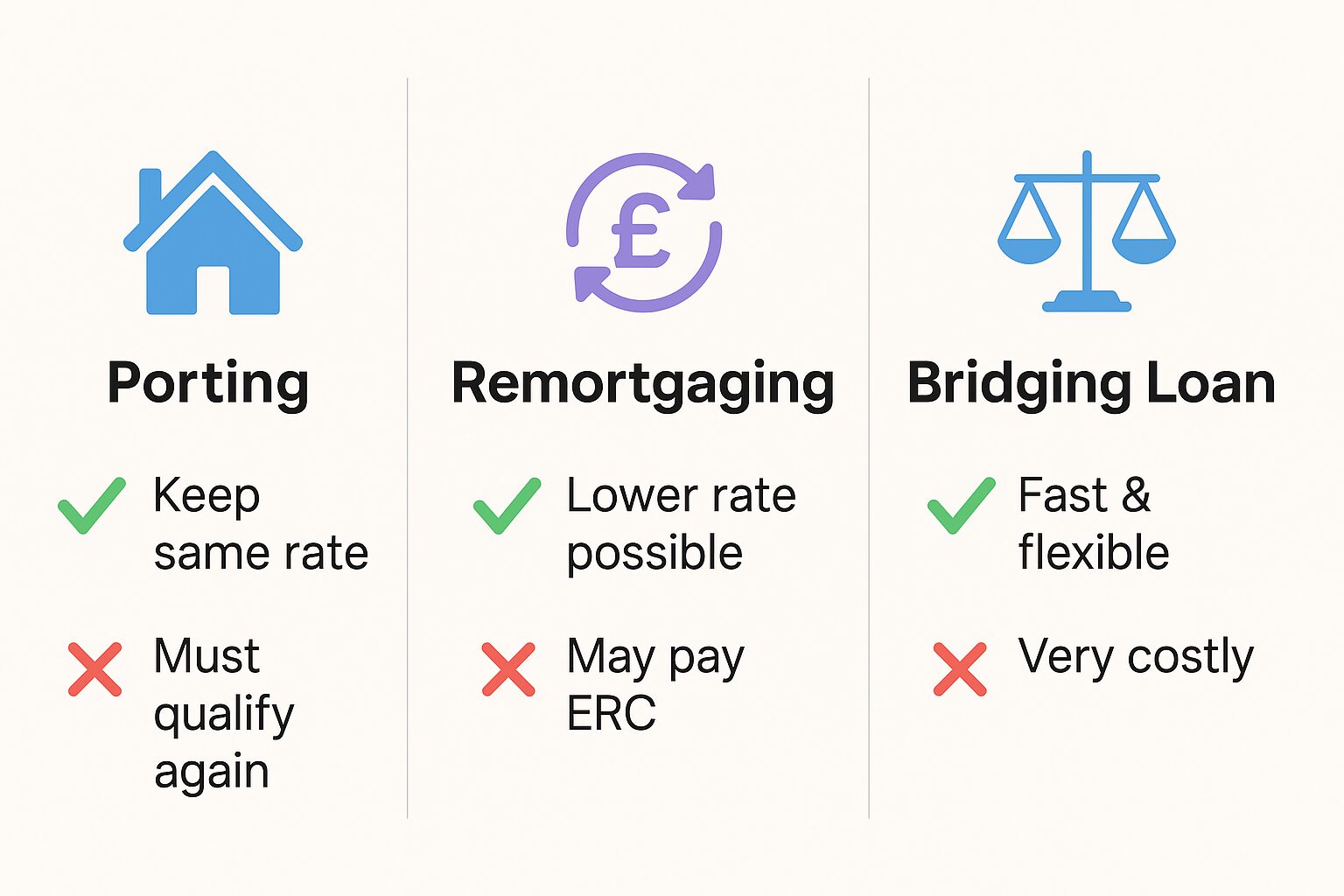

Pros & Cons of Mortgage Options

If you’re moving on to a new home, you’ve got a few ways to handle your mortgage transition.

1. Porting

Transfer your current mortgage to your new property. You still need to apply and qualify, but if approved:

- You keep the same rate.

- You avoid the ERC.

- Any extra borrowing will be on a new rate.

Drawback? Your lender might refuse if your income or new property doesn’t meet their criteria.

2. Remortgaging with a New Lender

Treat the move as a chance to find a better deal. You pay off your current mortgage on sale and take out a new one elsewhere.

- Good if your lender won’t port, or you’ve found a lower rate.

- You may have to pay an ERC on the old loan.

- Expect arrangement fees on the new one.

3. Bridging Loan

If you need to buy before selling, a bridging loan can cover the gap.

- Fast, flexible, but expensive.

- Used when timing is tight and no chain is possible.

- You’ll pay it off when your old home sells.

Only go this route if you’ve got a rock-solid exit plan.

The Mortgage Timeline for Sellers: 8 Weeks Out to Post-Completion

8 Weeks Before Completion – Offer Accepted

This is when the ball starts rolling.

- Instruct a solicitor who’ll handle redemption of your mortgage and contact your lender.

- Contact your lender (optional) to check:

- What’s your current balance?

- Are there any ERCs?

- Can the mortgage be ported?

- Start house hunting (if buying again) and explore porting or new mortgage options.

- Begin budgeting: Estimate what you’ll clear after paying off your mortgage and all fees.

6 Weeks Before Completion – Midway Mark

Things start getting real.

- Your solicitor might request a redemption statement to get an early idea of your final figure.

- Keep paying your mortgage as normal. No exceptions here.

- Check your building insurance is active until the day of completion.

- If you’re not buying again immediately, make living arrangements for the interim period.

4 Weeks Before Completion

Often, when the exchange of contracts is getting close:

- You should already ask your solicitor to get an updated redemption figure based on the planned completion date.

- Carefully review the redemption statement. Look for:

- ERCs

- Closure fees

- Daily interest rates (handy if dates shift)

- If you’ve exchanged, double-check:

- When your next mortgage payment is due.

- If you should let it go ahead or hold — ask your lender directly.

2 Weeks Before Completion (or at Exchange, if later)

This is where you prep the final details.

- Log in to your mortgage account or call your lender. Check:

- That your payments are up to date.

- That the account is ready to close.

- Don’t cancel anything just yet — not your mortgage, insurance, nor direct debit.

- If you’re buying on the same day, make sure the new mortgage funds are lined up and ready.

Completion Day – When the Magic Happens

This is the day you stop being a mortgage holder.

What actually happens:

- Buyer’s funds are transferred.

- Your solicitor sends the payoff amount to your lender.

- The mortgage is redeemed and your account is marked “closed”.

- You can now cancel your direct debit.

- Solicitor sends you any leftover funds (after mortgage, fees, and agent costs).

Important: Only cancel the direct debit after the lender confirms redemption. It’s usually done same day, but always double-check.

After Completion: Tidy Up the Loose Ends

You’ve sold up. Now tie off anything mortgage-related.

Tick these off:

- Get confirmation from your lender that your mortgage is fully repaid.

- Check for refunds:

- Overpaid interest

- Offset savings

- Ensure Land Registry shows the mortgage is removed.

- This is handled by your solicitor, but worth confirming in a month or two.

- If you bought another home, check:

- When your new mortgage payments start.

- That your direct debit is set up.

Common Pitfalls (And How to Avoid Them)

Cancelling Mortgage Payments Too Early

This is the #1 mistake we see.

Just because you’ve got a buyer, or you’ve exchanged contracts, doesn’t mean you can stop paying.

Until the completion date, the mortgage is still legally yours. Miss a payment and:

- You could harm your credit.

- The sale could be delayed or even fall through if your lender takes action.

Avoid it: Always confirm completion has happened before cancelling any payments.

Getting Caught Off-Guard by an ERC

Some sellers are shocked when they see a redemption statement that’s £5k more than expected — all because they didn’t realise an early repayment charge applied.

Avoid it: Check your mortgage paperwork early. If an ERC applies:

- See if you can port your mortgage.

- Try to delay completion until after the deal period ends.

- Or budget for it if it’s unavoidable.

Letting Insurance or Maintenance Lapse

You’re still responsible for the property until completion.

If you cancel building insurance before the buyer owns it and something happens — flood, fire, whatever — you’re on the hook.

Avoid it: Keep insurance active until the day of completion. Same goes for council tax, utilities, and basic property upkeep.

Redemption Statement Requested Too Late

If your solicitor waits until a day or two before completion to get your mortgage figure, and the lender’s slow to respond — you risk a delay.

Avoid it: Remind your solicitor to request the redemption figure at least a week in advance. And make sure it matches your actual completion date — even a day off means recalculating interest.

Spending Your Sale Funds Before the Mortgage Is Settled

Seems obvious, but it’s worth saying: you don’t “have” the money until your mortgage is fully cleared.

If you were planning to use proceeds to buy something big (like a car, or another property), wait until your solicitor confirms the mortgage has been redeemed and all fees settled.

Holding Two Mortgages Without Planning For It

Buying before selling? Or dealing with a slow buyer?

You could end up paying for two homes at once.

If you’ve got savings or a high income, fair enough — but for most people, this becomes financially unsustainable fast.

Avoid it:

- Align your sale and purchase dates.

- Or use a bridging loan with a clear exit strategy.

- Or rent in-between.

Expert Tips for a Smooth Transition

1. Start Talking to Your Lender Early

Even if you’re months away from selling, it pays to:

- Find out your exact balance

- Ask about early repayment charges

- Check if porting is an option

This gives you time to plan — and avoids nasty surprises mid-sale.

2. Time It Right (If You Can)

If you’re flexible, you can use timing to your advantage:

- Complete just after your regular monthly payment? You’ll avoid another one.

- Complete just before your fixed-rate deal ends? No ERC.

- Complete at month-end? Easier to wrap up finances cleanly.

You won’t always get the choice — but if you do, use it wisely.

3. Synchronise Your Sale and Purchase

Buying and selling on the same day? Then precision is key.

Make sure:

- Your old mortgage gets redeemed early in the day

- Your new mortgage funds are released on time

- Both solicitors are coordinating tightly

Heads-up: Most lenders charge daily interest from the day of completion. So yes, you might pay interest on both loans for that one day. That’s normal.

4. Carrying Two Mortgages? Have a Back-Up Plan

If you’re thinking of buying before you’ve sold, you’re not alone. But don’t go in blind.

- Can you genuinely afford both payments, even for 2–3 months?

- What if your sale falls through or drags?

- Have you got savings or a plan B (like renting out one property short-term)?

Don’t assume a bridging loan is your only option — but don’t ignore the risks of the other options either.

5. Dealing with Negative Equity? Don’t Wait

If your mortgage is more than your home’s worth, you’ll need your lender’s approval to sell.

That means:

- Telling them early

- Showing you’ve got a plan to cover the shortfall (savings, loan, or post-sale payment agreement)

Important: The lender must agree to release their charge on the property. Don’t assume you can just hand over the keys and walk away — you can’t.

6. Keep a Paper Trail

Save:

- Redemption statements

- Final account balances

- Emails with your solicitor/lender

- Confirmation that your mortgage was closed

You might never need them — but if a refund goes missing or your credit file shows an error, they’re gold.

Bonus: Selling Without Buying Again?

If you’re selling but not moving into another mortgage immediately (maybe you’re renting or relocating), then you’ve got a clean break.

This is a golden opportunity to reset your finances — use it wisely.

Ready to Stop Worrying About Mortgage Payments?

If you’re done with delays, stress, and juggling mortgage payments while trying to sell, we’ve got you.

At Property Rescue, we can buy your home in as little as 48 hours. No agents. No chains. No flapping about. Just a simple, direct, cash sale – fast.

An independent solicitor, whom we’ll pay on your behalf, will handle all your legal stuff and ensure your lender gets what they are owed and that you get the rest.

👉 Get your free, no-obligation cash offer now

No pressure. Just a clear next step to a fast, stress-free sale — and freedom from your mortgage.