Selling your house? There’s one golden rule: be upfront.

Gone are the days of “buyer beware”. These days, if you fail to disclose something important — like a historic flood, a neighbour dispute, or dodgy DIY — you could end up in legal hot water.

Under UK law, you must share all material information that could impact a buyer’s decision. That means anything from structural damage to rights of access must be declared. If not, you could face:

- Legal claims under the Misrepresentation Act

- A sale falling through last minute

- Or worse — being dragged through the courts for compensation

Buyers are protected now. And if you hold back? You risk everything from delays and price drops to full-blown lawsuits.

What You’ll Learn in This Guide

In this no-nonsense guide, we’ll walk you through:

- The exact laws and forms you’ll need to deal with (TA6, TA7, TA10 — don’t worry, we’ll explain)

- What counts as a “material fact” and why you’ve got to disclose it

- Common traps sellers fall into (and how to dodge them)

- The step-by-step checklist to get your home legally sale-ready

- And how to skip the hassle altogether if you’re in a hurry

Let’s dive in.

The Legal Framework for Seller Disclosures

Consumer Protection from Unfair Trading Regulations 2008

These regulations (also known as CPRs) flipped the script on selling houses in the UK.

Sellers (and estate agents) now have a legal duty to be honest and upfront about anything that could affect a buyer’s decision. No spin. No omissions. No “Well, I thought they might spot it during the survey”.

Fail to disclose? You’re potentially looking at criminal charges.

Business Protection from Misleading Marketing Regulations 2008

If you’re selling property as part of a business (like a developer or landlord), this regulation applies. It bans misleading marketing and requires clear, accurate descriptions of what’s being sold — right down to the size, location and condition.

Misrepresentation Act 1967

If you lie — or leave out something crucial — and the buyer finds out later, they can sue you for misrepresentation. They may ask the court to reverse the sale or claim damages.

This law is why even innocent mistakes (like forgetting to mention a resolved neighbour dispute) can come back to bite.

Sale of Goods Act

This applies mostly to fixtures and fittings included in the sale — so if you’re leaving that built-in fridge, it should work safely and as described.

Law Society Standard Forms

| Form | Key Purpose | Mandatory? |

| TA6 | Full property info: disputes, boundaries, defects | Yes |

| TA7 | Leasehold details: ground rent, charges, agents | If leasehold |

| TA10 | Fixtures & contents: what’s staying or going | Yes |

Here’s where the admin starts.

Most disclosures happen through standard Law Society forms your solicitor will give you. Let’s break down the big three:

TA6: Property Information Form

This is the master form. It asks about:

- Planning history

- Insurance claims

- Boundaries and disputes

- Environmental issues

- Utilities, occupiers, and more

Think of it as the full confession. Answer everything honestly — and if you’re not sure, say so.

TA7: Leasehold Information Form

Selling a leasehold? This one’s mandatory. You’ll need to share:

- Lease length and ground rent

- Service charges and future hikes

- Managing agent details

- Rules like no pets or subletting

Don’t leave buyers guessing. It only delays the process.

TA10: Fittings and Contents Form

Curtains? Washing machine? Garden gnome?

TA10 lists what’s staying, what’s going, and what’s negotiable — so there’s no squabbling on moving day.

Pre-Marketing Must-Haves

Want to hit the ground running when your property goes on the market? Get these essentials sorted before the listing goes live.

1. Energy Performance Certificate (EPC)

You legally need a valid EPC to sell a home in the UK.

It rates your home’s energy efficiency on a scale from A to G and is valid for 10 years. If yours has expired (or never existed), you’ll need to get one from an accredited assessor.

- Fixtures & Fittings Inventory (TA10)

You don’t want to argue over a tumble dryer.

Get ahead by filling out the TA10 form early. Go room by room and note down what’s staying and what you’re taking with you. This avoids last-minute arguments and price negotiations.

Pro tip: A better EPC rating can increase buyer interest — and even value.

3. Title Documents and Boundaries

Every buyer’s solicitor will want to see the title register and plan. These documents prove you own the place, and confirm:

- Property boundaries

- Easements (rights of way, access, etc.)

- Any charges or restrictions on the title (e.g., overage clauses or covenants)

If there’s ever been a boundary dispute, now’s the time to explain it. Even better — provide documentation of how it was resolved.

4. Leasehold Details (If Applicable)

Selling a leasehold property? Here’s what to prep:

- Lease length remaining (anything under 80 years can cause buyer headaches)

- Ground rent and service charges (plus any arrears)

- Details of your freeholder and managing agent

- Any planned major works or upcoming costs

- Whether there’s a sinking fund

Also request the management information pack — it can take weeks to arrive and often delays sales.

Material Facts to Cover in TA6

Let’s break down exactly what buyers need to know — and what the TA6 form is asking for. Miss any of these? You risk legal trouble later.

Planning & Building Control

Disclose:

- Any extensions, conversions or structural alterations

- Whether you got planning permission and building regulation sign-off

- Past enforcement notices or refused applications

Even if you didn’t personally carry out the work, but know it happened, declare it.

Structural Issues & Insurance Claims

Buyers need to know if your property has experienced:

- Subsidence or movement

- Flood or fire damage

- Large cracks or damp issues

- Major insurance claims or refusal of cover

If any of these occurred and have since been repaired — that’s fine. Just disclose it with proof.

Environmental Hazards

Legally, you must disclose:

- Past or present flooding (from rivers, drains, etc.)

- Radon gas risks (check the UK radon map if unsure)

- Contaminated land notices

- Asbestos

- Japanese knotweed — even if treated

Buyers will forgive many of these if they’re declared early — but if they discover it later, trust collapses.

Utilities & Services

- Are you on mains drainage or a septic tank?

- Any known issues with water pressure?

- Broadband availability or mobile black spots?

Mention them clearly — especially if you’re in a rural location.

Neighbours & Nuisances

Had a scrap over a fence? A noise complaint? An antisocial neighbour?

You’ve got to declare it — even if it’s resolved. Include:

- Formal disputes (past or ongoing)

- Noise complaints to or from the council

- Access disputes or shared driveway arrangements

And if your property’s ever been the site of a serious crime or death — yep, that goes in too.

Regulatory Notices

Have you received:

- Party Wall Act notices?

- Planning application notices for nearby works?

- Road expansion or HS2 route alerts?

If you’ve been notified of anything that could impact the property or area, it’s a legal obligation to disclose.

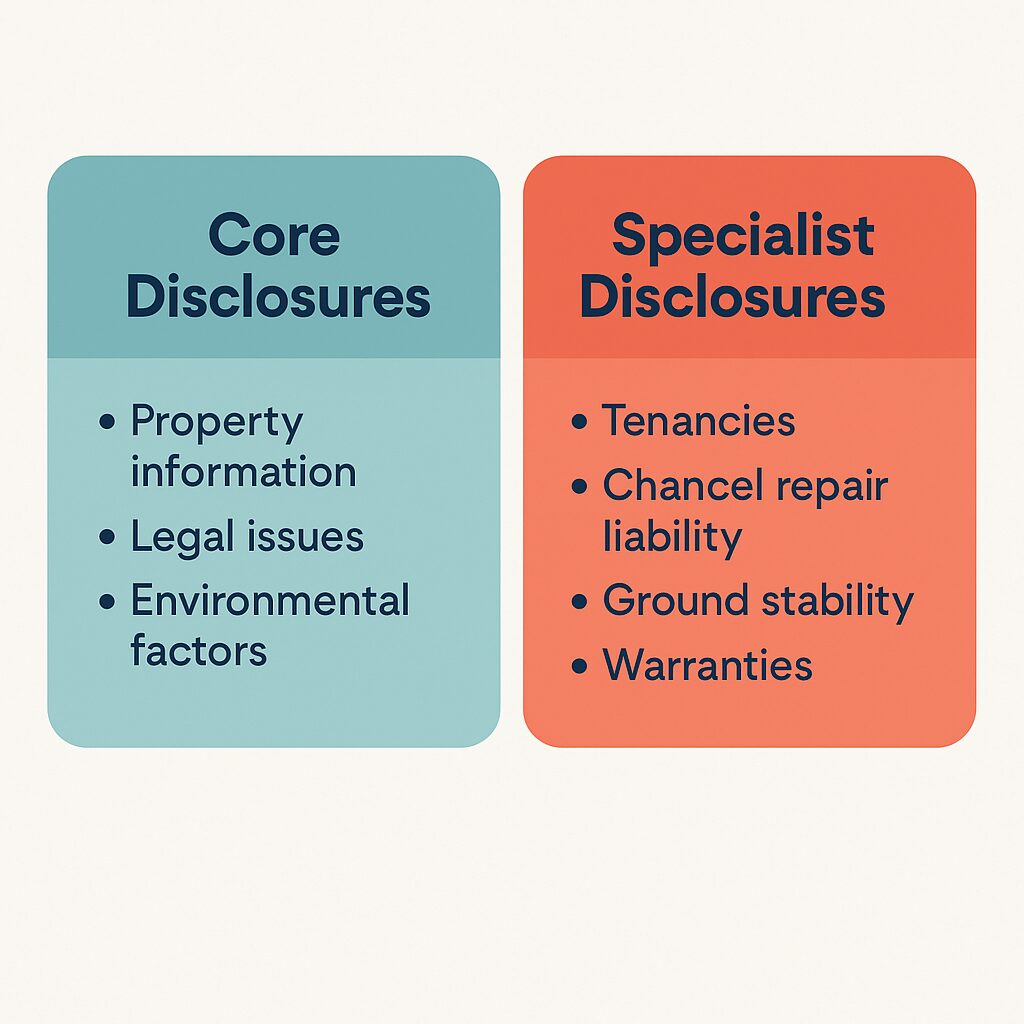

Specialist & Optional Disclosures

Beyond the standard forms, there are a few extra disclosures that aren’t always required, but should absolutely be declared if relevant.

Think of these as the “hidden traps” that can kill a sale if they come out later.

Guarantees & Warranties

Still have paperwork for:

- New roof or boiler?

- Damp-proof course?

- Double glazing (FENSA certificate)?

- NHBC warranty for a new build?

Include these in your disclosure pack. They add trust and value — and protect you legally if a buyer later questions the work.

Chancel Repair Liability

Rare, but real. This ancient law allows some churches to claim repair costs from nearby properties.

Check your title register to see if this liability applies. If it does, mention it — and consider telling the buyers they’ll need chancel repair indemnity insurance if applicable.

Mining, Brine or Ground-Stability Issues

If your home is in a former mining area, the buyer may want to see:

- A mining search

- Confirmation of ground stability

- Any known brine or landfill-related settlement

If you’ve already had these searches done — share them. It saves time later.

High-Voltage Cables or Flight Paths

Live near a pylon or under a flight path? These might not be deal-breakers, but you must disclose them.

Similarly, if there are mobile masts, substations, or anything with visual/noise impact — be upfront. Better to tell buyers than have them discover it on Google Earth.

Core disclosures vs specialist disclosures

If you’re letting the property or have occupants other than yourself, declare:

- Any AST (Assured Shorthold Tenancy) agreements

- Rent arrears

- HMO licence status (if let to multiple tenants)

- Occupancy arrangements (e.g. an ex-partner still living there)

Buyers need to know if the home comes with any “baggage” they’ll need to manage.

Risks of Incomplete or Inaccurate Disclosure

Let’s be blunt: if you try to hide something, it can come back to bite you.

Here’s what can go wrong:

The Buyer Pulls Out

Most commonly, non-disclosure leads to a sale falling through just before exchange.

Say a buyer’s solicitor finds something during local searches, like a flood risk you didn’t mention. The buyer feels misled and walks. You’re back to square one.

Legal Claims (Yes, Even After Completion)

Buyers can bring legal action up to six years after completion if they discover that you misrepresented something material.

They could:

- Sue for damages

- Demand compensation

- Even try to unwind the sale

And if Trading Standards gets involved? You’re facing fines and criminal prosecution under the CPRs.

Lower Offers & Reputation Damage

Ever heard of gazundering?

That’s when a buyer drops their offer — often just before exchange — because they feel you weren’t transparent. It happens. A lot.

In short: playing it straight protects you. It also gets your deal done quicker, at a better price.

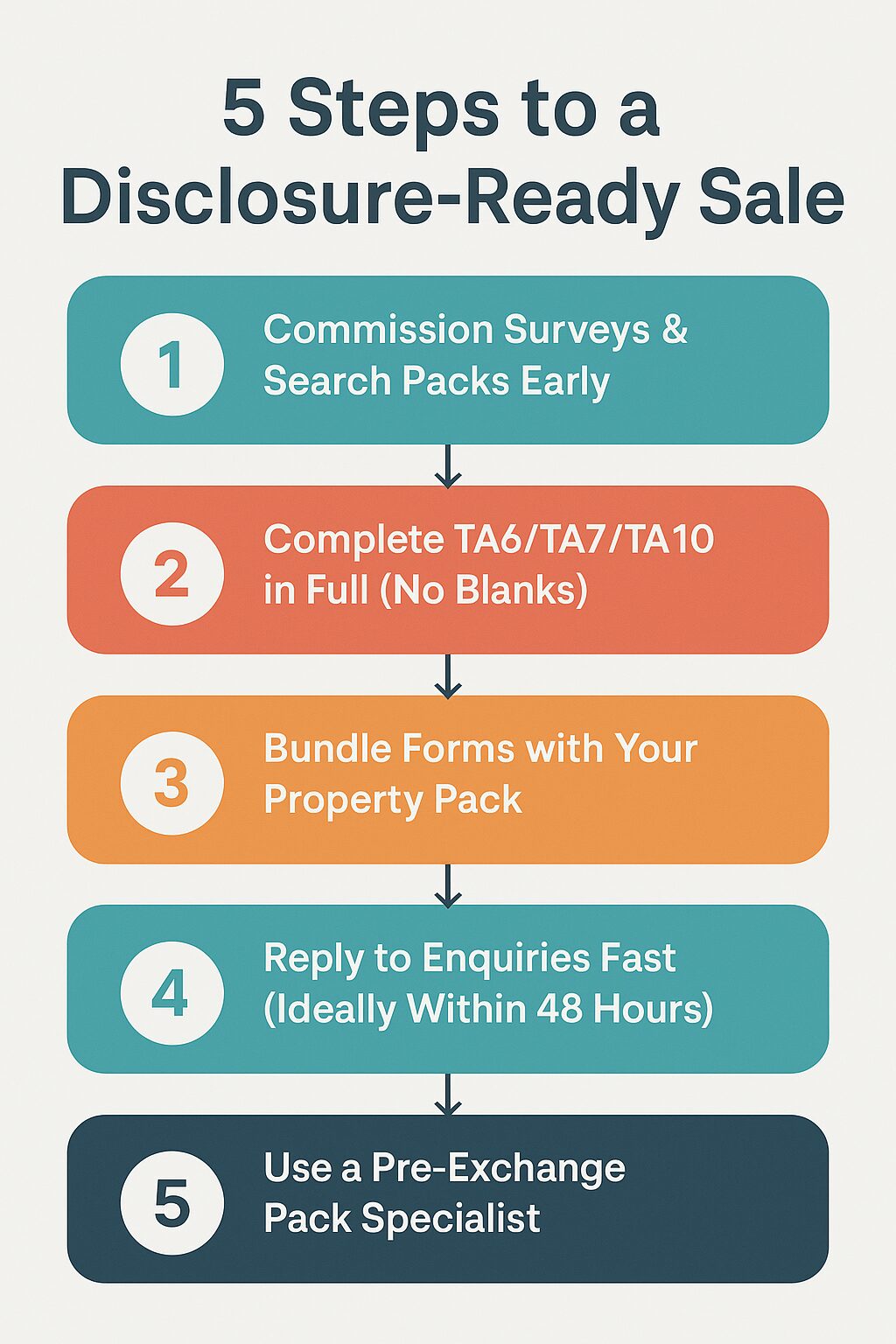

Best-Practice Workflow to Keep Your Sale on Track

Want a sale that glides from listing to completion — without back-and-forth delays or buyer cold feet?

Here’s a proven disclosure workflow that seasoned sellers (and pro conveyancers) swear by.

1. Commission Surveys & Search Packs Early

Don’t wait for a buyer to request searches. Be proactive.

Commission things like:

- Local authority searches

- Drainage & water reports

- Environmental risk checks

- RICS homebuyer survey (if you suspect issues)

This arms you with facts — and helps head off any surprises.

2. Complete TA6/TA7/TA10 in Full (No Blanks)

Avoid vague answers. Don’t leave sections blank.

If you don’t know something, write “Not known” or “To the best of my knowledge…”

Leaving blanks slows the process and raises red flags for solicitors — which can spark a flurry of extra enquiries.

3. Bundle Forms with Your Property Pack

You must include your disclosure pack when you send out your marketing materials, such as brochures, floor plans, or EPCs.

It signals to buyers that you’re organised and honest, and gives their solicitor a head start. You may even get fewer queries down the line.

4. Reply to Enquiries Fast (Ideally Within 48 Hours)

Solicitors love sellers who respond quickly.

If a buyer’s solicitor asks for clarification, don’t let the questions stack up. Each delay risks:

- Losing momentum

- Buyer frustration

- Your deal collapsing to someone more responsive

5. Use a Pre-Exchange Pack Specialist

Some conveyancers specialise in “pre-exchange disclosure packs”. They’ll help:

- Get all your forms ready up front

- Advise on how to word sensitive disclosures

- Chase leasehold management info

- Handle title clarifications or indemnity insurance

If speed is your goal, work with someone experienced in this kind of proactive legal prep.

How Property Rescue Streamlines Your Sale

Sound like a faff? We get it.

That’s exactly why Property Rescue exists — to cut through the legal red tape and help you sell fast, fair without the drama.

We’ll buy your property directly from you for cash

Once you get in touch, we can:

- Make a cash offer within 24 hours

- Exchange contracts in as little as 48 hours

- Complete the sale in just 7–14 days

And we’ll handle all the legal stuff — searches, surveys, solicitor coordination — on your behalf.

No Worries About “Bad” Disclosures

Got a damp issue? Short lease? Noisy neighbours?

We’ve seen it all. And we still buy.

We Cover Legal Fees (No Hidden Costs)

We’ll foot the bill for:

- Standard solicitor fees

- Property searches

- Admin costs

- All other costs

No estate agent fees. No surprise deductions. Just a straight, transparent and direct sale.

Get your free valuation now — no obligations, just straight-talking advice and support.

Let us handle the fine print.

You focus on your next chapter.